Public Blog List

Aug.15, 2022

Trustworthy financial systems of making money should stand true during good times and bad.

They need to have been proven over time.

Put Mining doesn't attempt to beat the S&P or Nasdaq returns.

It is 4.5years into proving that you can squeeze another 10+% annually out of your current financial strategy.

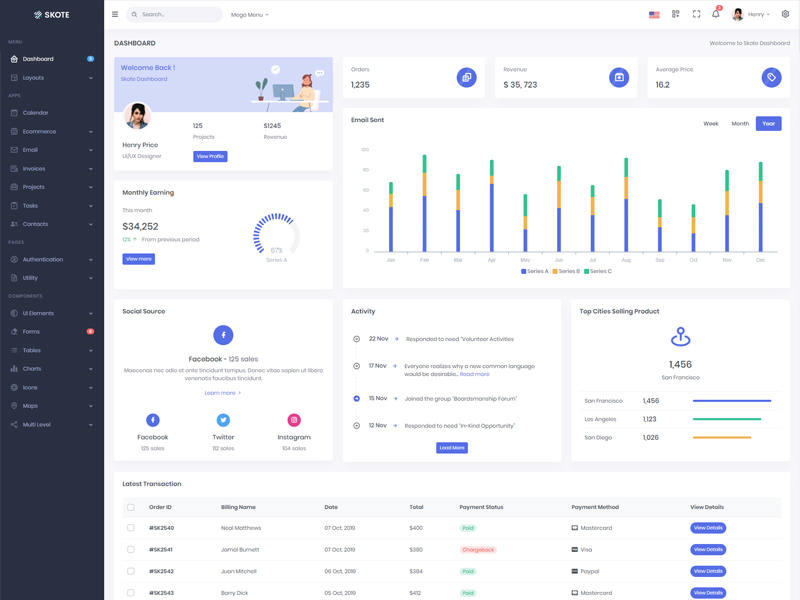

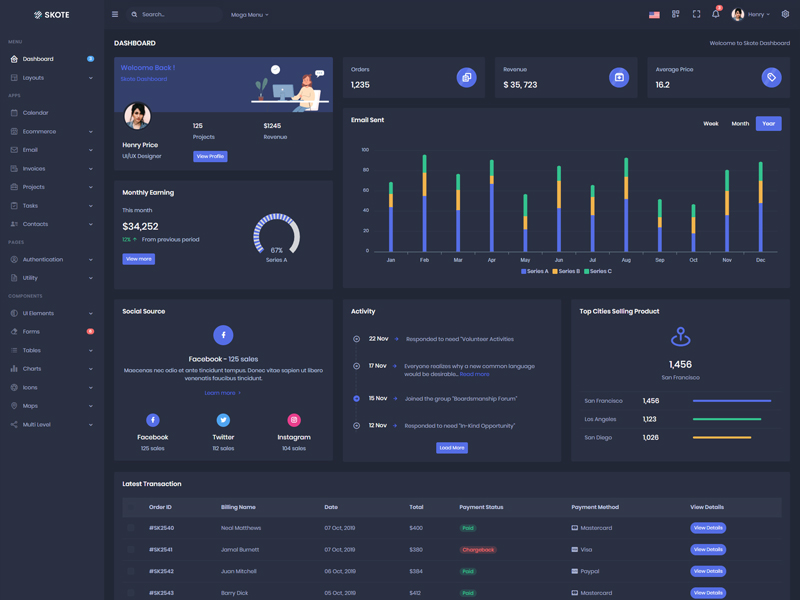

Here are the Put Mining Stats to date:

Jul.25, 2022

There are many doomsday folks in the media and social media these days.

There are just as many people claiming that we've reached "the bottom".

This is just a reminder that you, alone, are responsible for your own investment choices.

When both "sides" disagree so heavily, be sure to mitigate your risk so that you're prepared for either "camp" to be right.

Invest intelligently!

Here are the latest Put Mining stats:

May 16, 2022

Put Mining Stats to date:

Apr.30, 2022

When investing for capital gains, you lose in a down market and break even in a neutral market.

When investing for dividends, you win in all markets even when your capital decreases.

When adding Put Mining to dividend investing, you still get the dividends but also have capital wins in upward markets, neutral markets, and even down markets.

The added risk is when overleveraging meets a large correction or crash.

Since neither corrections nor crashes can be predicted, we provide a Leveraged Risk Factor Calculator to help you learn to mitigate your own risk.

We don't want to attempt to guide you into which dividend stocks to choose or even deter you from investing for capital gains.

We just show you what is possible by adding Put Mining to your investing strategy/ies.

Apr.9, 2022

The statistics of Mined Puts are of great interest since they include over 4 years of data.

We don't claim to have a perfect record, and our stats include the learning curve.

The older the system grows, the more reliable it becomes.

We won't consider this artificial intelligence, but we do apply the algorithms and filters based on dynamically collected statistics.

Mar.19, 2022

It's important to mitigate your risk in everything -- especially investing.

Market ups and downs must be expected and planned for.

If done well, you might not make as much as the greedy in upswings, but you won't be sweating in down markets.

Many people brag about their big wins, but those same folks rarely show their losing hands.

If you make 60% gains for two years in a row, and then lost 50% the third year, you'll have less than if you just made a consistent 10% for three years straight -- SIGNIFICANTLY worse if you factor in the taxes.

Our advice is to not be greedy. Rather, be consistent.

Use our Portfolio Leveraged Risk Factor Calculator as a tool to help you mitigate your risk.

Feb.28, 2022

After 4 years of Put Mining, we've seen some ups and downs -- including the large "down" of Covid's March 2020.

But we're still ahead and confident!

Volatility is still at a high.

That means higher risk, but it also means higher premiums when selling put options!

To help compensate for the added risk, Put Mining increases the requirements necessary for the drop in price between current and the option strike price.

We've found that the premiums are raised disproportionately, so this takes advantage of that and gives us an edge.

Jan.8, 2022

We're starting the New Year out with some generosity.

We realize that folks with portfolio sizes of less than $5k will end up having to give ~50% of their Put Mining gains (11.4% to date!) to our fees.

If you're one of those starting out, send us a message via "Contact" and we'll work something out with you.

Another disadvantage of smaller accounts is that a more expensive stock might tie up more buying power than your comfort zone allows.

For example, if you had a $5k portfolio size and we posted a VIAC play at a strike of $25, a single contract would put you at 50% of your portfolio size if put.

($25 x 100/contract = $2,500)

Any higher strike might be considered too risky to play.

And, then, you'd be unable to do other plays until that one expired.

We would rather help you learn than put you out of your comfort zone.

Dec.18, 2021

It never feels good to be put when you didn't want the shares.

However, remember that we don't likely have to be put.

If you watch the plays regularly, you can keep ahead of them by rolling.

This is why we strongly value the percent drop needed to be put.

Put Mining aims to filter out the put plays that actually will be put.

To date, we're accurate 81.5% of the time (our goal is 80%).

Also remember that these picks are good value companies.

If you do get put, they're not bad stocks to own at the prices we Mine them at.

For more details on rolling and other helpful information, check out our "How To" pages.

Oct.16, 2021

We were put some Mined plays this week.

It's important to note that they were all avoidable by proactively rolling in advance.

There was only one that flipped at the last minute (last two days).

On Wednesday it was still looking okay. But, then, on Thursday at open, it took a dive, leaving you two days to roll.

Typically, when rolling, we aim for diagonal rolls (as discussed in the How To pages).

In this case, the drop was significant enough that only a standard roll was possible (same strike but rolled to November).

This could still be done for a decent profit (>20% annualized) even with less than two days until expiry.

However, for the purposes of tracking the Put Mining picks, we don't consider rolls.

Rather, we let the plays run so that we know the overall effectiveness of the picks without altering the original picks.

You'll see the puts updated in the stats section below.

And we'll keep it updated for when those plays have "recovered" (ie. we assume that you'd put in a sell order for the price they were put at).

We do NOT believe in subtracting the premium you received (the actual cost basis), because you would then be taking away from your "income" from Put Mining.

Here are the Put Mining stats to date:

Sep.4, 2021

"Size Matters".

Our ultimate goal here is to use as little of our own money as possible (if any) to get the most consistent annual gains with the lowest amount of risk.

Integral to this, is knowing what size of transaction you should make.

Here, we use these Put Mining statistics to help teach you how to size your plays properly.

Check out our How To section to learn more.

Aug.28, 2021

We've upgraded the Leveraged Risk Factor Calculator to version 7.0.

It's now more clear when helping to guide you to mitigate your risk.

The link to it, of course, is available under the How To tab for paid subscribers.

Here are the Put Mining stats to date:

Aug.22, 2021

Even after a few plays being put on Friday, the Put Mining stats still hold strong!

Aug.1, 2021

We were asked:

I prefer to annualize by day using 360 day returns to compute the annualized premiums - the same method the financial organizations use. It's no different than weekly, right?

And we said:

For plays that are opened and closable on a daily basis, we agree (eg. buying and selling shares, selling options and then buying them back, etc).

But options, if played until expiry, only close on Fridays -- their expiry date.

This is, at most, once per week.

Annualizing options by day is not practical even if you use a 360 day year.

In fact, it can mislead you with false data.

Let's demonstrate with an example using covered call options for simplicity:

- An investor has a $500k portfolio fully invested in one company, ABC, and nothing on margin.

- So 5,000 shares of ABC valued at $100/share.

- This investor requires around $100k per year to live before taxes.

- They calculate that their required $100k/year from their $500k portfolio is 20% per year.

To accomplish this, every Monday, they choose to sell covered calls at a $110 strike for a premium profit of $0.25/share to expire 4 days later on Friday.

That works out to $1,250/week (0.25 x 5000shares).

To determine if this premium is sufficient for their requirements, they annualize the premiums by day and calculate:

- 20.7% using a 365 day year -- 0.25premium / $110strike / 4days x 365

- OR... 20.5% using a 360 day year -- 0.25premium / $110strike / 4days x 360

Since they find that it's greater than 20%, they execute the play and repeat it for every week of the next 52 week year.

However, after a year, they find that they have no free cash and scrounging for money to make ends meet.

How could this be?

The error was that they annualized by day for a play that can only be repeated once per week.

Had they annualized by week, they'd have calculated:

- 11.8% using a 52 week year -- 0.25premium / $110strike / 1week x 52

- OR... 11.3% using a 50 week year -- 0.25premium / $110strike / 1week x 50

Or simply take the $1,250/week income and multiply it by:

- 52weeks = $65k or 13.0% of $500k.

- OR... 50weeks = $62.5k or 12.5% of $500k.

So our example investor barely made half of what they required due to the simple math error of annualizing by day on a weekly strategy.

The lesson summary is that, if you know your % portfolio goal and you want to meet it, for a:

- daily strategy, then annualize by day. For example buying and selling shares the same day, or a few days later.

- weekly strategy, then annualize by week. For example options that you are hoping to expire worthless.

- monthly strategy, then annualize by month.

- quarterly strategy, then annualize quarterly. For example most dividends.

- annual strategy, then annualize by year.

- multiple-year strategy, then still by year. For example gov't bonds, etc.. that expire 10 years out, will have their gains listed in annual %s simply by dividing by 10 years.

For this reason, Put Mining statistics and calculations always annualize by week using a 50 week year to ensure that nobody gets less than the premiums they expect.

Here are the Put Mining System's stats to date:

Jul.25, 2021

3 active Put Mining plays had a symbol change over the weekend.

The list of Active Plays has been modified to accommodate.

Here are the Mined Put stats to date:

Jul.18, 2021

Put Mining stats to date:

Jul.3, 2021

Put Mining stats for Happy Canada Day and Independence Day celebrations!

Jun.19, 2021

A large number of Mined Puts expired yesterday -- 27 to be precise.

Their transaction dates varied from Nov.4, 2020 to Jun.9, 2021.

And all of them went without being "put" (aka expired worthless).

This is the ultimate goal of Put Mining!

This also means that each of these plays are free and clear, the premiums collected are yours, and you are no longer on the hook for anything related to these plays.

Again, the Theoretical Put Mining Portfolio follows strict rules (as should yours!) to determine which of the Mined Puts can be applied to the portfolio.

You can read more about these in the How To section.

Here are the statistics to date using this method for additional income:

Jun.5, 2021

We were asked:

How does Put Mining work?

And we replied:

The details are revealed to paid subscribers on the How To page.

But in a nutshell, every week typically a handful of put option plays are offered.

We "mine" these option plays for you from thousands of available options, filtering them for the best income to risk balance.

If played in appropriate proportions to your portfolio size, they average out to 0.2% per week and, at the same time, helps you protect yourself from over-exposing yourself.

That 0.2% per week works out to over 10% per year of additional income without changing your current holdings whether they be stocks, mutual funds, indexes, etc. The current stat (also listed below) is 11.8% per year.

Below, you'll find the statistics of our theoretical portfolio as well as all the other puts that have been Mined to date.

If you'd like to understand more about Put Mining, how these statistics were attained, and how they're used to help gauge your overall portfolio risk, consider becoming a paid subscriber if you aren't already!

May 22, 2021

We have updated our Leveraged Risk Factor Calculator (version 6)!

Paid subscribers have free access to this tool in order to help mitigate the various forms of leveraged risk when used cumulatively.

We were asked:

How can I practice option trading?

And we answered:

Once you've been approved for option trading by your brokerage and after using the "paper trading" features that most brokerages offer, consider trying some REAL option trades.

But wait until after hours.

That way, you can see them live (avoiding any stupid little differences that paper trading does).

Once you see your open order waiting for the market to open, practice changing the order, canceling it, etc.

There's always a learning curve with brokerage software and interfaces.

These are some of the things you DON'T want to have to learn the hard way!

May 15, 2021

Hypothetically, if you assume that you need $100k to retire and you make 5% in portfolio dividends, you'll need a portfolio size of $2 million before you can economically retire.

Even if Put Mining only made you just 10% in additional income (as seen in the stats, it's actually higher), it would bring your portfolio size requirement down to $666,667 in order to make the same $100k in annual income.

That is 3x less capital needed!

Below, you'll find the statistics of our theoretical portfolio as well as all the other Puts that have been Mined to date.

If you'd like to understand more about Put Mining and how these statistics were attained and how they're used to help gauge your overall portfolio risk, consider becoming a paid subscriber if you aren't already!

May 9, 2021

We were asked:

What's the purpose of the "Theoretical Put Mining Portfolio"?

And we answered:

Nobody has an unlimited amount of money.

Since we encourage folks to invest based on percentages of their own personal portfolio sizes, at levels of risk that suit their personal/family situations, and for the stage of life they are at, we had to realize that not everyone can play every Mined Put.

Therefore, we created a Theoretical Put Mining Portfolio that follows specific rules, uses no emotion, but doesn't overextend itself.

Plays that don't make it to the Theoretical Put Mining Portfolio are only left out because they just didn't "fit" in the Portfolio at that time.

That means that the portfolio was either at 100% put risk, that play would have tipped it over 100% put risk, etc.

From this portfolio, we gather portfolio statistics that you see posted weekly.

To make the numbers more strict and honest, we assume that the income from Put Mining is never reinvested.

Doing so would result in compounded, even higher returns (highly encouraged if you're not living of of the income)!

The purpose of the Theoretical Put Mining Portfolio, then, is to produce realistic estimates of what you may experience on the portion of your portfolio that you might decide to apply the Put Mining principles to.

Naturally, past performance does not guarantee future performance, so invest with knowledge.

And as many questions so that you may!

Once enrolled, visit the "Theoretical Portfolio" section on the "How To" page for more details.

Here are the statistics to date:

May 1, 2021

Imagine making 11.8% additional income on your portfolio value annually by offering to buy great company's shares for prices lower than they currently are selling for.

We did. And that's what Put Mining is all about.

Below, you'll find the statistics of our theoretical portfolio as well as all the other Puts that have been Mined to date.

If you'd like to understand more about Put Mining and how these statistics were attained and how they're used to help gauge your overall portfolio risk, consider becoming a paid subscriber if you aren't already!

Apr.24, 2021

"Put Risk" is a misleading term.

We use this value to help identify how leveraged we are when using margin.

Technically, "put risk" refers to the cost of the stock that you have promised to purchase by selling/writing a put option at a known price (strike) if the stock price falls below that price before the expiry date.

At PutMining.com, we encourage only selling put options on good/value companies and at discount prices (strikes).

So, if you are "put" the stock, you will be owning a good company's stock at a discounted price!

THIS is how we prefer to define it.

'Put Risk'' = The chance to own a good company's stock at a discounted price AND getting paid a premium to take that chance.

And being "put" the stock is something that we've only had happen 16.2% of the time (to date).

One of the reasons we need to calculate "put risk" is for the purpose of learning and tracking how to mitigate your overall risk.

In most cases, this means that we're helping you learn to keep away from getting a margin call.

You are safe from margin calls in tax-deferred, Roth-IRA type portfolios since margin isn't allowed for those types of accounts.

But these types of accounts also limit your ability to triple leverage your income potential.

(We'll argue intelligent people using of those types of accounts on another day.)

Below, you'll see the statistics of our theoretical portfolio as well as all the other Puts that have been Mined to date.

If you'd like to understand more about Put Mining and how these statistics were attained and how they're used to help gauge your overall portfolio risk, consider becoming a paid subscriber if you aren't already!

Apr.17, 2021

To keep the statistics free from as many variables as possible, we use a theoretical portfolio that does not have margin, owns no stocks (to eliminate chance of portfolio growth or decline), makes no dividends (to further isolate chances of considering other income), and all of the theoretical income made from Mined Puts are assumed to be withdrawn, taxes paid, and spent (equivalent to living off of).

Therefore the theoretical portfolio's capital size never changes.

This theoretical portfolio also follows rules so as to eliminate all emotion.

To be clear, you would NOT do this. We have organized the theoretical portfolio of Mined Puts to provide you with performance details isolated to only Put Mining choices over time.

With this in mind, when you add in your own stock choices, dividends, etc, the addition of Put Mining with margin can truly be considered to be an additional stream of income/cash flow.

If you'd like to understand more about Put Mining and how these statistics were attained, consider becoming a paid subscriber if you aren't already!

Here are the statistics of our theoretical portfolio as well as all the other Puts that have been Mined to date:

Apr.10, 2021

Put Mining is a method of leveraging your current portfolio to make income in addition to your current dividend income and portfolio growth strategies.

It is most effective when used with margin, but it's not necessary.

When used with margin, you're essentially using other people's money without paying for it (picture Danny DeVito here).

If you'd like to learn more about how to make a dollar earn money for you multiple times, consider subscribing!

Here are statistics to date to show how your stock investments can make an ADDITIONAL income using Put Mining.

Mar.27, 2021

As you might know, VIAC took a dive this past week.

However, by design, Mined Put plays aren't at risk by this.

This is because we follow limits recommended by Bill Spetrino.

As of market close yesterday (Fri.Mar.26), our only VIAC Mined Put would need to fall 68.9% further in order to be "put".

As you can see in the stats, the closest of ANY of the (currently) 19 active plays to being "put" is 16.5%.

And the average is 38.2%.

This means that, on average, the company shares we've played here need to drop 38.2%.

AND if that happens, we don't lose anything. Instead, we just get great deals on great company's shares!

Of course, it isn't always this way. The overall market is at a high.

The object of Put Mining is to make income in both good times and bad by being careful and reasonable.

Not greedy.

Feel free to Contact us (button on top) with questions.

Mar.20, 2021

Updated Put Mining stats to date:

The most significant values are those summarized in red.

This data is averaged per year for over 3 years, where the assumption is that the income generated is used as income to live on, NOT reinvested to help the account compound.

Of course, if you are still building your account, you would likely be reinvesting to compound and build faster!

Mar.13, 2021

Feel free to "Contact" us if a stat needs explaining. Such as why a 97.9% Put Risk value is a good thing.

Feb.20, 2021

Feb.6, 2021

Jan.23, 2021

Jan.16, 2021

Jan.2, 2021

Dec.19, 2020

Dec.12, 2020

Nov.21, 2020

Oct.17, 2020

Oct.4, 2020

Sep.19, 2020

Sep.5, 2020

Aug.29, 2020

Aug.22, 2020

Aug.9, 2020

Aug.2, 2020

Jul.25, 2020

Jul.19, 2020

Jun.27, 2020

Jun.20, 2020

Jun.13, 2020

Jun.7, 2020

May.25, 2020

May.16, 2020

May.3, 2020

Apr.18, 2020

Apr.10, 2020

Apr.4, 2020

Mar.23, 2020

Mar.15, 2020

Mar.8, 2020

Feb.23, 2020

Feb.15, 2020

Feb.8, 2020

Feb.1, 2020

Jan.25, 2020

Jan.11, 2020

Jan.4, 2020

Dec.22, 2019

Dec.16, 2019

Dec.7, 2019

Nov.30, 2019

Nov.16, 2019

Nov.9, 2019

Nov.2, 2019

Oct.26, 2019

Oct.19, 2019

Oct.12, 2019

Sep.21, 2019

Sep.14, 2019

Sep.8, 2019

Aug.26, 2019

Aug.4, 2019

Jul.29, 2019

Jul.22, 2019

Jul.15, 2019

Jul.10, 2019

May.25, 2019

Apr.27, 2019

Apr.13, 2019

wefwefwef

wefwfwef